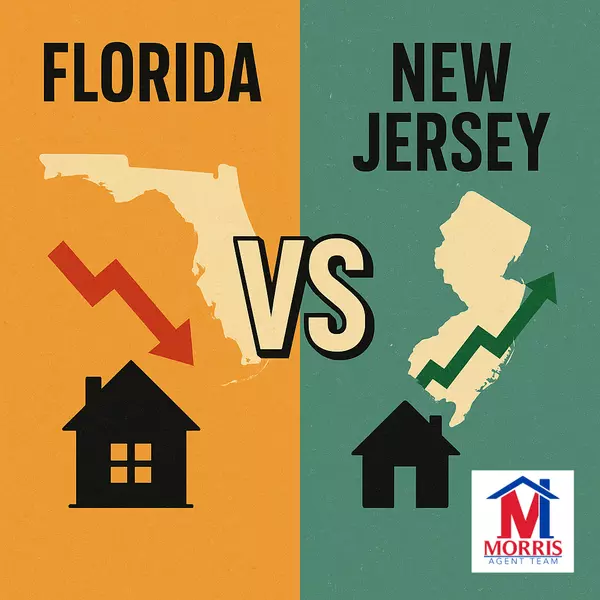

Here’s why the Florida market is sliding—and why New Jersey isn’t following suit.

1. Florida Got Greedy—Fast

Let’s call it what it is: Florida’s boom was emotional. Post-pandemic, everyone and their cousin fled to the Sunshine State. Why? Lower taxes, remote work flexibility, and the fantasy of palm trees and freedom. Home prices shot up too fast, with too little substance behind them.

In places like Tampa and Cape Coral, values skyrocketed 60–70% in under three years. That’s not normal. That’s speculative.

What happens when speculation drives a market? Eventually, reality shows up with a bill. Insurance premiums went through the roof, mortgage rates doubled, and suddenly—those “dream homes” were underwater, figuratively and in some cases, literally.

2. Insurance Crisis + Climate Risks = Buyer Turnoff

This one’s a biggie. Florida’s property insurance market is in absolute crisis mode. Major insurers have pulled out, premiums are up 40–60% in a year, and it’s now a full-blown affordability issue. Try explaining to a buyer that their $600K home comes with $12K in annual insurance premiums—and that’s if they can even get a policy.

Flood zones, hurricane risk, and now wild climate unpredictability? That’s turning off investors and relocating retirees. People are asking, “Do I really want to gamble with my largest asset in a state that’s literally sinking?”

Meanwhile in NJ, yeah, we get snow. But we don’t have a 3-month hurricane season, and we’re not dealing with 6-figure rebuilds from wind damage. Our insurance market is stable, and our risk tolerance is much lower—and smarter.

3. Investor Overload and Sudden Exit

A big chunk of Florida’s market was gobbled up by institutional investors and out-of-state Airbnb buyers. They inflated the comps. Now they’re fleeing.

With tourism fluctuating and Airbnb regulations tightening in some cities, those short-term rentals aren’t cash flowing. Investors are liquidating. That means more listings—at slashed prices—and the dominoes start to fall.

In NJ? We never had that kind of investor saturation. Most of our buyers are end-users—families, professionals, and folks who actually live in their homes. That builds real stability. Our appreciation wasn’t a sugar high. It was earned.

4. Wages vs. Housing Costs

Here’s a simple equation: If home prices outpace wage growth by 2x or 3x, you’re headed for a crash.

In Florida, the average income in many areas simply can’t support the mortgages people signed up for in 2021. Add inflation, insurance, and taxes? Game over.

In New Jersey, we’ve got higher average incomes, more diverse industries, and a job market that supports real estate values. Northern NJ is supported by NYC commuters, pharma, tech, logistics—you name it. These aren’t transient economies; they’re anchors.

5. People Want to Be Here

Let’s be real—New Jersey gets a bad rap in the memes, but people want to be here. Our schools? Top notch. Proximity to NYC and Philly? Unmatched. Towns like Boonton, Morristown, Ridgewood, Montclair—they’re destination towns.

We’re not a vacation fantasy—we’re a lifestyle. And people pay for that kind of access and quality of life, regardless of the market cycle.

Final Thoughts

Florida’s housing decline isn’t a fluke—it’s a correction from overhype, poor fundamentals, and unsustainable risk. New Jersey isn’t immune to market shifts, but we’re built different. Literally and figuratively.

If you're thinking of making a move, don't chase hype. Invest where the demand is stable, the risks are measured, and the lifestyle holds real value.

No surprises. Ever.

#NoHype #MorrisAgentMoves #RealEstateTruth #FloridaBubble #NJsNotThatGuy #NoSurprisesEver

Categories

Recent Posts

GET MORE INFORMATION